Sunday Essentials - Your weekly Crypto digest is ready.

All of the essential crypto news, that you can’t afford to miss.

Friends,

It’s that time of week again.

All of the essential crypto news, that you really can’t afford to miss.

Nothing but phat, juicy, crypto intel.

LET’S RIDE.

Gone in 60 seconds🏎️💨

For those who’ve got shit to do and cars to jack…

Here's your 60 second digest summarising this week in crypto. More details below.

SEC abandons $ETH investigation 🏆 How the turn tables Mr Gensler… The SEC has abandoned its quest to quash $ETH. This is a huge victory for the industry and signals a new era for crypto with a precedent firmly set for future crypto’s to build upon. This also emphasises the wider shift in attitudes warming towards crypto as seen first hand through the presidential campaigns.

Is Trump Launching a MEME Coin?! 🤔 Probably not… but this is symbolic of the direction we’re heading. MEMEs are likely to hot up the closer we get to November. It’s building towards a potential sell the news event.

Whales are accumulating - Michael Saylor just keeps buying $BTC 🐳 Michael ‘Chad’ Saylor has just bought another $786 million worth of $BTC. That’s now just the 226,331 bitcoins ($15 billion worth). Gulp. Turn you mind off. When Whales accumulate, we accumulate. We discuss more in depth how this is a sign of things to come and how this cycle really could be the last ‘golden’ bull market…

BONUS! We’re also trialing a brand new segment. Try and stay calm and stick around to the end to find out this weeks: ‘Take of the Week’.

SEC abandons $ETH Investigation 🏆

Well, well, well.. Mr Gensler.

If you’ve been living under a rock for the last 4 years, let me get you up to speed:

The SEC hates crypto. They have tried everything possible to defame, diminish and destroy the crypto industry over the past 4 years.

They fear the decentralisation of money and what it will mean for the US dollar.

$ETH is our beloved Queen, and Gary Gensler at the SEC has been coming for her.

So it comes as no surprise that we as an industry should embrace this moment.

Of course, the $ETH ETF served as a prelude to this news.

But it cannot be understated that this really is the coach throwing in the towel moment that definitively draws a line under this frustrating chapter for $ETH.

Why is this so important?

Precedent.

You know how these things work: Once one domino falls, the rest fall in line.

As outlined, $ETH is our Queen.

Yes she may be a bit old. She might be a bit slow and she is definitely not perfect…

But warts and all, she remains the Head of State for our ALT bags.

Her success is crucial to our bags.

So $ETH triumphing over the US Government is a symbolic victory for the wider industry.

This precedent will allow those who follow her to reach even higher heights.

There are even rumours circulating about the potential for a $SOL ETF?

We’re not sure about this at the moment, but it shows the possibilities now this precedent has been set.

What does this say about the wider crypto landscape and sentiment?

Our take? Bullish.

This is one of many recent changes in attitudes towards crypto.

The presidential debate has been fascinating to watch.

Because after four years of Biden’s war on crypto - it appears that he is beginning to realise that he needs our money.

In May, it was revealed that Trump raised 40% more (£44m) for his campaign than Biden.

The Biden camp has now started to consider receiving donations in crypto.

To do this, Biden would most likely have to use Coinbase Commerce, the same payment service that Trump has currently utilised.

The irony.

The same Coinbase that the SEC has hammered with lawsuits for the last four years.

For us, this is signalling a wider shift in attitudes towards crypto.

The attack on the crypto industry has failed. The SEC has shown this.

So as the old saying goes: ‘If you can’t beat them, join them.’

Long-term, the future is looking very good.

But caution is needed. Election times always lead to promises that are rarely able to be kept.

Let’s see how this all pans out. But regardless, the SEC defeat is a milestone for $ETH and crypto.

Is Trump Launching a Meme Coin?! 🤔

There is no evidence that this is true but can you imagine, lol.

Earlier this week, rumours started to circulate on X that $DJT (Trump Coin’) had been launched on the Solana blockchain and was created by the Trump camp.

Although this is incredibly unlikely, this speaks to the sentiment around crypto at this time.

$DJT (the stock ticker for Trump's social platform ‘ Truth Social’) has become a meme token since going public in March.

It’s clear that at this time, a Trump victory would be the desired outcome for crypto.

This also presents a ‘Sell the News’ opportunity.

What you need to anticipate is a bullish trend upwards going into the election.

You also need to be equally cautious that even if Trump is victorious, the market will likely sell-off after the election.

Plan accordingly.

P.S. if you think rumours of a President creating their own meme coin in the midst of running for presidency is wild?

Sh*t is going to get so much weirder the deeper we go into this Bull market.

Whales are accumulating - Micahel Saylor just keeps buying $BTC 🐳

MicroStrategy, chaired by the chad that is Michael Saylor, has acquired an additional 11,931 bitcoins for $786 million.

That’s now just the ₿226,331 holdings, valued around $15 billion. Gulp.

Crypto can be a complicated sector, but sometimes it's important to make sure that you don’t over complicate things.

You can’t go wrong by following the habits of whales.

Do you think they would be accumulating this aggressively at these levels if they didn’t see prices rising in the medium to long term timeframes?

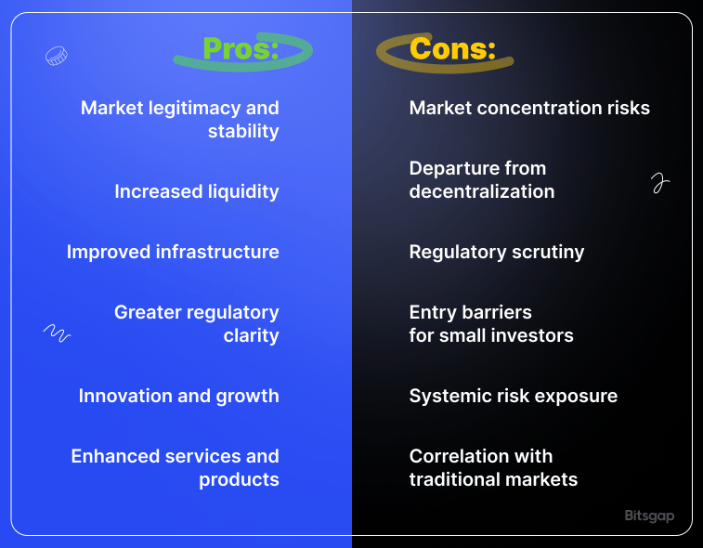

The reason why this is being dubbed the ‘Golden Bull’ by so many respected voices in the industry is that this will be the last cycle before institutions have fully infiltrated the industry.

This is bittersweet in many ways. The money flowing in from institutions is like nothing we’ve ever seen in crypto before.

We’ve already casually glided past previous ATH without even slight retail interest.

The thesis remains that we will rip so hard due to institutional money combined with retail flocking back to create a golden, one of a kind, crypto bull run.

After that? We think those nostalgic crypto 100X’s will be so much harder to come by.

Gains will be made of course, but regulation and market manipulation by institutions will make it very difficult for small retail investors like us.

Use this as a reminder that this is time sensitive. Don’t wait around. This is THE cycle.

@Bitsgap

Take of the Week 👏

We’re trialling a new segment! Introducing, ‘Take of the Week’.

This is a particularly good take that we’ve seen this week, and what you can learn from it.

FULL CREDIT TO: @milesdeutscher

This tweet highlights 3 important principles that you need to internalise if you are to be successful in crypto:

Remaining vigilant

Spreading your bets

Market sentiment

But underlying all of these principles are two truths you need to accept.

Risk and Bias

Risk

By participating in crypto, you are accepting all of the risk.

This is daunting when you first begin. But empowering as you grow in confidence.

It makes the highs that much higher, but the lows that much more painful.

Ultimately there are an infinite number of coin combinations that you can buy and hold.

But copying people on X or from a newsletter (*cough cough*) does not make it their fault if things don’t turn out well.

We’re all risking our asses out here.

Even $BTC is classified as a risky asset relative to traditional stonks.

So your sub $20 mil ALTS are incredibly volatile.

There’s a chance we go to zero. You have to accept this.

We don't think that's going to happen.

But this mindset will discipline you to not invest beyond your means.

Bias

We are all biassed.

We all find ways to confirm these biases through the information that we consume.

We ignore what doesn't serve us; we focus too much, or cling to information that enforces our ideas.

For investing, this is the worst characteristic you can have.

Systemising your investment is the simplest way to lock in returns.

Don’t set arbitrary numbers like ‘I’ll sell my ALTS when $BTC hits $150K.’

It won’t work. You’ll move the goalposts.

Our advice? Take initial stakes off the table as quickly

That's all for this week folks!

Enjoy your Sunday.

Stay sharp.

The Bull Trap.